Investing in real estate is a dream that many Kenyans aspire to, but limited funds can often be a barrier. However, the option of buying land on hire purchase or through installment plans has opened up new avenues for individuals with tight budgets.

As a real estate agent in Kenya, I have witnessed firsthand how this approach has empowered people to achieve their property ownership dreams.

In this article, we’ll explore the process of buying land on hire purchase/installments and share snippets of success stories from individuals who turned their dreams into reality.

Understanding Hire Purchase/Installment Plans:

Buying land through hire purchase or installments involves making periodic payments over an agreed-upon period until the full purchase price is settled. This allows individuals to secure their piece of land without having to pay the entire amount upfront.

It’s essential to work with reputable developers and sellers who offer transparent and fair terms for the installment plans.

In my years as a real estate agent, I’ve encountered numerous clients with limited funds who were determined to become landowners. One inspiring story is that of Stehen Omondi. With a modest income, he thought homeownership was out of reach. However, they decided to explore installment plans offered by a trusted developer.

The Omondi family started with a small down payment and committed to monthly installments that fit comfortably within their budget. Over the years, as they diligently made their payments, they witnessed the development of their property.

Today, they proudly own a piece of land that they can call home. Their story is a testament to the transformative power of buying land through installments.

Steps to Buying Land on Hire Purchase/Installments:

Research and Identify Reputable Sellers:

Begin by researching real estate developers or sellers who offer land on hire purchase or installment plans. Look for reviews, testimonials, and recommendations to ensure credibility.

Assess Your Finances

Evaluate your financial situation and determine a realistic budget for the down payment and subsequent monthly installments. Ensure that the payment plan aligns with your income and financial goals.

Verify Land Ownership and Documentation

Before committing to any agreement, ensure that the land is legally owned by the seller. Verify all necessary documentation, such as title deeds and survey plans, to avoid any legal complications in the future.

Process of due diligence in Kenya

Negotiate Favorable Terms

Engage in open discussions with the seller to negotiate terms that suit both parties. Be transparent about your financial capabilities and seek a payment plan that accommodates your budget.

Legal Assistance:

Consider seeking legal advice to review the contract and ensure that the terms are fair and legally binding. This step adds an extra layer of protection for both the buyer and the seller.

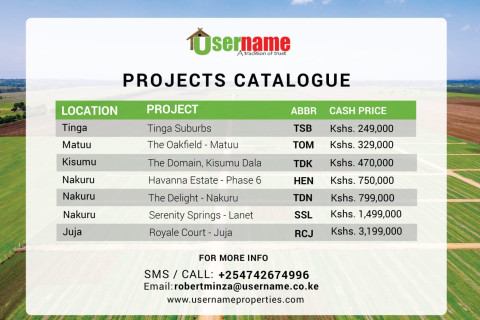

Here are properties on sale by Username Investments in installments.

To get more details on these properties, call Robert by clicking on link below

Conclusion:

Buying land on hire purchase or through installments in Kenya has made homeownership a reality for many individuals with limited funds. As a real estate agent, witnessing these success stories has been incredibly rewarding.

By researching reputable sellers, assessing your finances, verifying documentation, negotiating favorable terms, and seeking legal assistance, you can navigate the process confidently.

The journey to property ownership might be challenging, but with determination and the right approach, it can lead to a fulfilling and transformative experience.