Buying land is one of the biggest financial decisions you will make in life, but it also has its challenges. The Mavoko and Kirima Land Saga taught us valuable lessons that every person thinking about buying land should know. In this article, we’ll go through the ten essential things you need to know before you start buying land in Kenya.

1. Do a Land/site visit of the Land

When buying land in Kenya, prospective buyers often overlook the crucial step of conducting a thorough on-site inspection. One common mistake is relying solely on online listings or second-hand information, leading to misconceptions about the actual condition and suitability of the land. To avoid this pitfall, it is important for buyers to personally visit the land they intend to buy.

Imagine a friend who fell for glossy online photos but faced a different reality when they finally visited. The gentle slope promised turned into a steep hill, a surprising twist that could’ve been avoided. Skipping this step may lead to unexpected bumps in the road, turning your dream investment into a headache. So, grab your hat and visit that land before sealing the deal!

2. Conduct due diligence

Don’t forget to do your homework when buying land in Kenya. Researching and getting advice is like having a magic ball that shows potential problems. Imagine a friend who didn’t do this and faced unexpected issues with the land they bought. By doing your homework, you make sure the land matches your dreams. Talk to locals and ask experts. It’s like a safety net for your investment. So, before you make it official, gather information because a bit of research can make your journey to owning land easy and satisfying.

3. Conduct an Official search of the Land at the Land registry

Many people miss out on this important step, and it can lead to unexpected problems. Checking if the seller is the real owner of the land is crucial for a hassle-free deal. The great thing, it doesn’t cost anything. Just bring the original title deed, and copies of the seller’s pin and ID. In only two days, you can find any issues and make smart choices. Don’t take risks with your dream land. A fast trip to the Land Registry protects your investment and ensures a safe path to owning your property.

Read: How to Conduct Land Search on Ardhisasa.

4. Do a company /organization search selling the land

Imagine a neighbour rushing to buy land, only to realize they knew nothing about the company selling it. Avoid this mistake! Before diving into a land deal, it’s like checking reviews before picking a restaurant do your homework on the selling company. Ensure they’re legit and trustworthy. Our fictional friend learned the hard way, discovering hidden fees and legal hiccups. Take a moment to Google, ask around, and make sure the company is as solid as the ground you want to own. A quick search can save you from a plot twist you never bargained for.

5. Never Purchase a land without original title deed

Ever heard the tale of a buyer so eager to own a slice of Kenya that they forgot the golden rule? Picture this: a friend excitedly securing land without a title deed, thinking it’s just paperwork. Cue the plot twist without that original title deed, it’s like buying a book without a cover. Never skip the title deed step. It’s your proof of land ownership, a tale of legitimacy. Ensure that original title deed is firmly in your hands before celebrating your land conquest in Kenya; it’s the happy ending you’ll thank yourself for.

Read: Types of Title Deeds In Kenya and How to Obtain Them

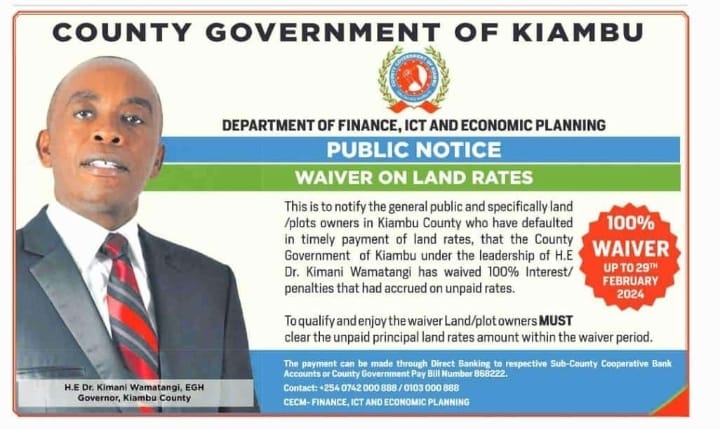

6. Confirm any unpaid land rent/rates

Before sealing the deal on your dream land in Kenya, ensure you confirm any outstanding land rent or rates. Overlooking this detail might lead to unexpected financial burdens. Imagine the surprise of discovering overdue payments after the purchase! Take a moment to check with the local authorities or land office to verify the property’s financial standing. It’s a crucial step to avoid post-purchase headaches and ensures a smooth transition into land ownership. Remember, a small effort to confirm unpaid land rent or rates upfront can save you from a significant hassle down the line, allowing you to enjoy your new property stress-free.

Read: How to Pay Land Rent on Ardhisasa

7. Involve the right professionals

To safeguard against scams when purchasing land, it’s important to involve professionals throughout the process. Engaging the following experts ensures a secure transaction:

Lawyer: They play a crucial role in drafting the agreement between the buyer and seller. Both parties can share one advocate to minimize costs.

· Valuer: Necessary for valuing the land, determining stamp duty, and ensuring a fair transaction.

· Surveyor: Conducts ground verification and assists in processing essential land maps.

Read: Who Should Be Involved in Your Land Transaction in Kenya?

8. Always have a sale agreement and proof of payments

When buying land in Kenya, protecting yourself is a must. Make sure to get a sale agreement and keep proof of your payments. It’s like having a map when sailing unknown seas crucial for a safe journey. The sale agreement and payment records act as your legal support, stopping arguments and making everything clear. Don’t let the excitement of getting land make you forget about these protections. They ensure your land purchase is safe and straightforward. With a sale agreement and payment proof, you’re not just buying land you’re ensuring a worry-free investment in peace of mind.

9. Don’t hurry the Land Buying Process

When buying land in Kenya, it’s a mistake to rush through the process. Hurrying can make you miss important details like property boundaries or legal checks. Slow down; buying land is like a careful dance, and each step is important. Take time to check documents, inspect the land, and make sure it fits your plans. Being patient is worth it avoid the problems of rushing, and enjoy the satisfaction of making a well-thought-out and safe land purchase. Taking your time ensures your dreams are built on a strong foundation.

10. Developing a property is not grounds of being saved from evictions

People from both the Mavoko and Kirima land sagas really believed that because they had constructed properties, they could not be evicted. Please keep in mind that, when determining ownership of any property, the fact that it has been developed is not even among the top five considerations considered by the court. Its very important to have an original title deed before doing any developments on any property.

Don’t be conned!https://www.youtube.com/embed/sPIHfKZ58JI

Here is the Process of buying Land in kenya

https://www.youtube.com/embed/sPIHfKZ58JI